What’s in the Federal Budget | ACOSS commentary | Sector views | Download PDF | Main Budget Page

Key Points

- This Budget is a welcome shift from a strategy that cuts benefits and services to reduce the deficit to one that strengthens public revenue. Policy decisions increase revenue by $21bn over four years and raise expenditure by $15bn over the next four years.

- The two main revenue-raising measures are a 0.5% rise in the Medicare Levy ($8bn over 4 years) and a large bank levy ($6bn).

- The Medicare Levy increase is not the only way to secure revenue for essential services, including the NDIS, but it is far better to fund essential services through the progressive income tax system than to leave them under-funded or to charge those who use them.

- Much more must be done to strengthen revenue – by closing tax shelters and loopholes used by people with high incomes and through income-based levies like the Medicare Levy – to ensure that we all have essential services and benefits when we need them.

What’s in the Budget?

- The Medicare Levy will increase by 0.5% to 2.5% from July 2019, which the Government says will close a ‘funding gap’ for the NDIS. Taxpayers earning less than approx. $22,000 (if not a parent) or $37,000 + $3,400 per child (for families with children) will not be affected.

(Revenue: $4,300m in 2020-21 and $8,200m over 4 years) - A ‘major bank levy’ of 0.015% of liabilities on certain business and investment accounts will apply from July 2017 to the five banks with liabilities of over $100bn.

(Revenue: $1,600 million in 2020-21 and $6,200 million over 4 years) - Black economy task force to continue; new reporting requirements for contractors in courier and cleaning services.

(Revenue: $900m over 4 years) - Tightening the Multinational Anti-avoidance law (to prevent profit-shifting) by extending its scope to foreign trusts and partnerships as well as companies.

(Revenue: not specified) - Tightening the small business Capital Gains Tax concessions.

(Revenue: not specified) - Tightening of tax treatment of rental property to reduce avoidance of GST, limiting inappropriate deductions, and extending Capital Gains Tax to foreign home-owners.

(Revenue: $800m in 2020-21 and $2,100m over 4 years)

ACOSS commentary

ACOSS has argued consistently that as demand for essential services grows and the population ages, governments will need more revenue to guarantee access to essential benefits and services when we need them.

The alternatives are more harsh spending cuts such as those announced in the 2014 Budget, or to charge people for services (such as health, education and aged care).

Government revenue is expected to rise from 23.2% of GDP in 2016 to 25.4% in 2020, still less than the 25.9% of GDP raised in 2000-01 before eight un-affordable tax cuts. Most of this increase comes from personal income tax ‘bracket creep’ rather than comprehensive tax reform that closes major tax shelters and loopholes.

In previous Budgets, the Government announced personal income tax cuts (costing $4bn over 4 years) and company tax cuts (costing $2bn in 2019 and much more in later years). Australia simply cannot afford any more un-funded tax cuts.

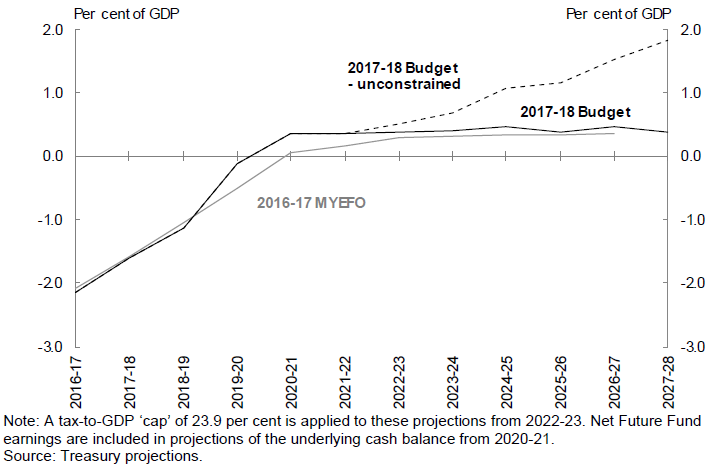

Regrettably, the Government has imposed an arbitrary cap on tax revenue of 23.9% of GDP (see graph below). Australia is the 6th lowest taxing country in the OECD. Comprehensive tax reform to secure adequate revenue in a fair and efficient way is serious unfinished business. ACOSS has called for $16B in extra revenue raised in 2019-20 through reforms including:

- restricting ‘negative gearing’ ($0.3bn in 2019-20 and much more in later years);

- halving the ‘discount’ for capital gains ($0.5bn);

- phasing out excessive Capital Gains Tax concessions for small business ($0.3bn);

- tighter tax treatment of private trusts ($1.5bn) and companies ($1.2bn);

- removing the exemption from the 0.5% Medicare Levy surcharge for high income-earners with private health insurance ($4.1bn);

- further curbs on multinational tax avoidance through debt-shifting ($0.5bn); and

- extending the 15% tax on super fund earnings to the ‘retirement phase’ ($1.3bn).

Graph: Underlying cash balance projected to 2027-28

Sector views

- Australian Federation of Disability Organisations: ‘Funding of NDIS now secure’

- Disabled People’s Organisation Australia: ‘Great NDIS and job support win, but harsh welfare measures for people with disability’