Australian income support since 2000: Those left behind. Build back fairer, report no. 2

This report is the second in the ACOSS and UNSW Sydney Poverty and Inequality Partnership’s COVID-19 Build Back Fairer Series. The Report analyses the changes to key income support payments from 2000 to 2021. It provides a comparison of the changes to income support highlighting who has been left behind. Its purpose is to inform debate about how our income support system can be improved to deliver a fairer post-pandemic Australia.

The purpose of the Build Back Fairer Series is to help us understand the different aspects of change, and who is most badly affected by the pandemic. The series draws together data on the impacts of the COVID recession on income support, employment, inequality, wealth and regions.

The first report in the Build Back Fairer Series, Analysis of income support in the COVID lockdowns in 2020-21 analysed the changes to income support arrangements for people in different locations across Australia during the COVID pandemic, covering the period September 2019 to September 2021. The first report, with its interactive maps, found that the areas more economically disadvantaged pre-pandemic have also typically been the areas hit hardest by the economic effects of pandemic up to the present time. This second report shows the people who have been impacted most by changes to income support payments over the past 20 years, both negatively and positively.

We trust this report will assist decision-makers to design policy responses to build back fairer in a manner that includes people hit hardest by the effects of the COVID pandemic, including those on the lowest incomes.

The Poverty and Inequality Partnership between ACOSS and UNSW Sydney includes researchers from multiple disciplines in order to fully explore the ways in which inequality and poverty are related to other measures of disadvantage, such as health, housing and homelessness and justice.

We are grateful to those ACOSS members and philanthropists who continue to support this vital research and impact partnership, including Anglicare Australia; Australian Red Cross; four Australian Communities Foundation funds (the Impact Fund, Hart Line Fund, Raettvisa Fund and the David Morawetz Social Justice Fund); the BB and A Miller Foundation; the Brotherhood of St Laurence; cohealth, a Victorian community health service; Good Shepherd Australia New Zealand; Mission Australia; the St Vincent de Paul Society; the Salvation Army; and The Smith Family.

Cassandra Goldie & Carla Treloar

Key findings

- From June 2000 to 2021, Australia’s median household income has grown by 45% in real terms, and the minimum wage has risen by 23.5%. Over the same period, the single Age Pension rose by 52%.

- For sole parents with a child under eight, their income has risen by 27.2%, whilst the income of those with children over eight rose by just 7.9% over the twenty year period.

- JobSeeker Payment rose by 12% in real terms, almost entirely because of the $25pw increase to the base rate in April 2021 (there was a small increase in 2013 when the Energy Supplement was introduced). The last time the base rate of the payment was lifted above Consumer Price Index (CPI) was in 1994 when it rose by just $2.95pw.

- The unemployment payment rate has fallen in comparison with the minimum wage since 2000 (from 50% down to 41% of replacement value), apart from the period when the Coronavirus Supplement was paid.

- The percentage of people receiving the lower unemployment payment who have a partial capacity to work (who may have previously been eligible for the Disability Support Pension (DSP)) has increased from 5% in 2007 to 33% in 2021.

- The percentage of sole parents receiving the lower unemployment payment JobSeeker has increased from 0% in 2000 to 28% in 2021.

- The payment rate of the Age Pension and the Disability Support Pension is much higher than that of JobSeeker when compared with the minimum wage

Since the turn of the 21st Century, Australia has seen major transformations in the economy and in household incomes. Nationally, both grew strongly in association with the mining investment boom in the early years. The Global Financial Crisis in 2008 brought an end to this growth, though the impact was nowhere near as severe as in North America and Europe. Since 2011, Australia’s economic growth has continued, though at a slower pace – and then there was the COVID-19 crisis in 2020 and 2021.

Changes in income support since 2000

In this report, we review how the level of income support for people in different life circumstances has changed over this period. While there have also been many changes to the administration and enforcement of activity requirements over this period (mainly to the detriment of recipients), the focus of this report is on trends in the levels of different income support payments and eligibility.

These results complement those in our series of Poverty in Australia core reports, most recently Poverty in Australia 2020: Part 2, Who is affected and Inequality in Australia 2020: Part 2, Who is affected and why. While the earlier reports have used data on actual household income, encompassing incomes from multiple sources, this report focuses on basic entitlements. With this narrower focus, we are able to cover the period from the turn of the century until the present, avoiding the lags in collection, processing and release associated with household survey data on incomes.

The Age Pension and Disability Support Pension have increased in line with wages, while JobSeeker and Parenting Payments fall further behind

This report revisits many of the themes considered in the earlier reports, though also includes information on recent trends during the COVID-19 crisis. In short, the performance of the Australian income support system during this period of economic growth has allowed whole groups of people to fall further and further behind the rest of the community. While payments have increased for some groups (people receiving age, disability and carer pensions), other groups, particularly people who are unemployed and sole parents, have been left behind. This has occurred both via payments that have not increased in real terms, but also via policy changes that have shifted many on to lower rates of payment.

The great exception to this two-decade trend was the COVID-associated increases in income support for working-age people in 2020. For a brief period, this increased a wide range of payments to above poverty line levels. But this adequacy was very short-lived. Despite continuing economic disruption, payment levels have now returned to close to their pre-pandemic levels.

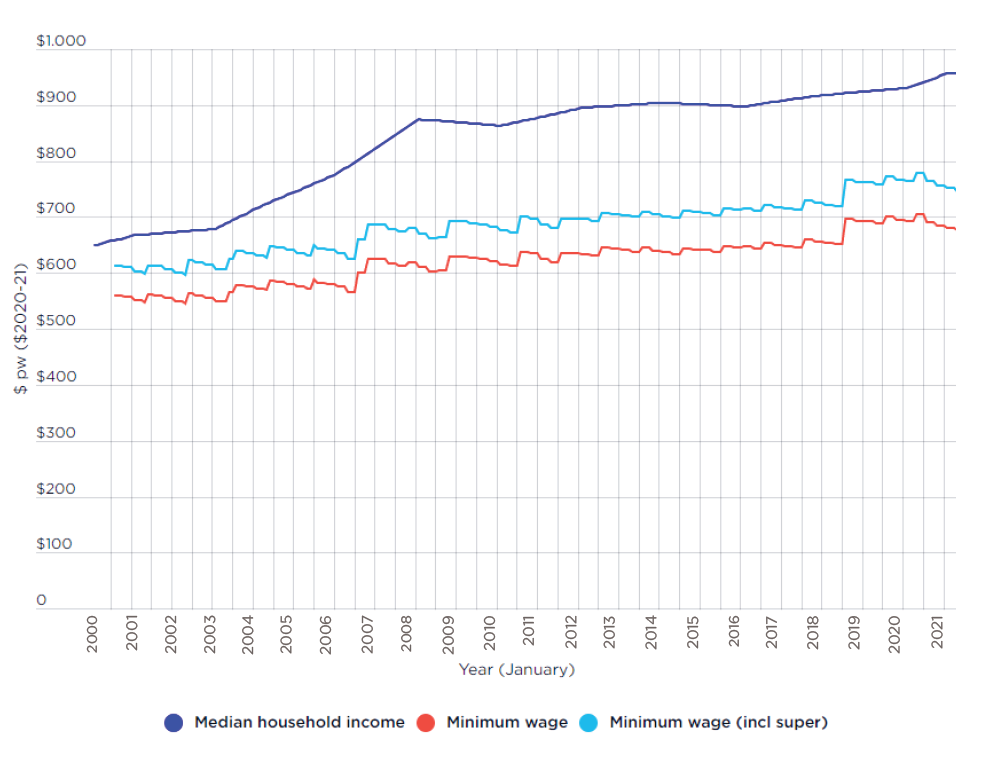

Figure 1 shows two indicators of community income growth, median household income and minimum wages. All income amounts in this, and subsequent figures, are converted to 2020-21 dollars using the CPI.

Median household income is calculated from the Australian Bureau of Statistics (ABS) income surveys up to 2017-18 and preliminary ABS data on household income for the more recent periods. It takes into account all regular household cash income sources, and adjusts for household size using an equivalence scale (see Appendix for details). For example, a two-person household has its income divided by 1.5, this income is assigned to each person, and then the median across all people is calculated. While the adjusted income only equals actual income for single person households, the median of this measure is a good estimate of how the living standard of the ‘middle person’ has changed over time.

One half of median household income is often used as a poverty line in research examining poverty trends over time or across countries, and so this is indicated in some of the figures below. This poverty line has also been used in previous reports in the Poverty and Inequality series, though the main results in this series have been based on an ‘after-housing’ poverty line which takes housing costs into account.[1]

Median incomes grew strongly during the mining investment boom of the early 2000s and then dropped slightly after the Global Financial Crisis in 2008-2009. Since 2011, household income has continued to grow, but at a very slow pace. From June 2000 to 2021, we estimate that median equivalised household income grew by 45 per cent in real terms.

The figure also shows the after-tax income of a single person reliant upon full-time minimum wages (without any casual loading). Such a person fell further behind the living standard of the average person during the mining boom, but has broadly kept pace after that period. The gap during the mining boom arose because of increased employment, an increase in wage inequality (Borland and Coelli, 2016) and growth in non-wage income. From June 2000 to 2021, we estimate that single full-time minimum wage without any casual loading increased by 24 per cent in real terms.

The figure also shows the minimum wage including compulsory employer superannuation contributions for comparison with later figures (superannuation is not included in the median household income line).

Figure 1: Community income growth since 2000

Note: Household income is after deducting tax and is per-equivalent adult. The minimum wage is after-tax but does not include any casual loading. The minimum wage including super adds compulsory employer superannuation contributions. See Appendix for calculation methods.

[1] The half median income measure is sometimes described as a ‘before-housing’ poverty line. See Bradbury and Saunders (2011) for a discussion of these alternative measures on poverty trends since the turn of the century.

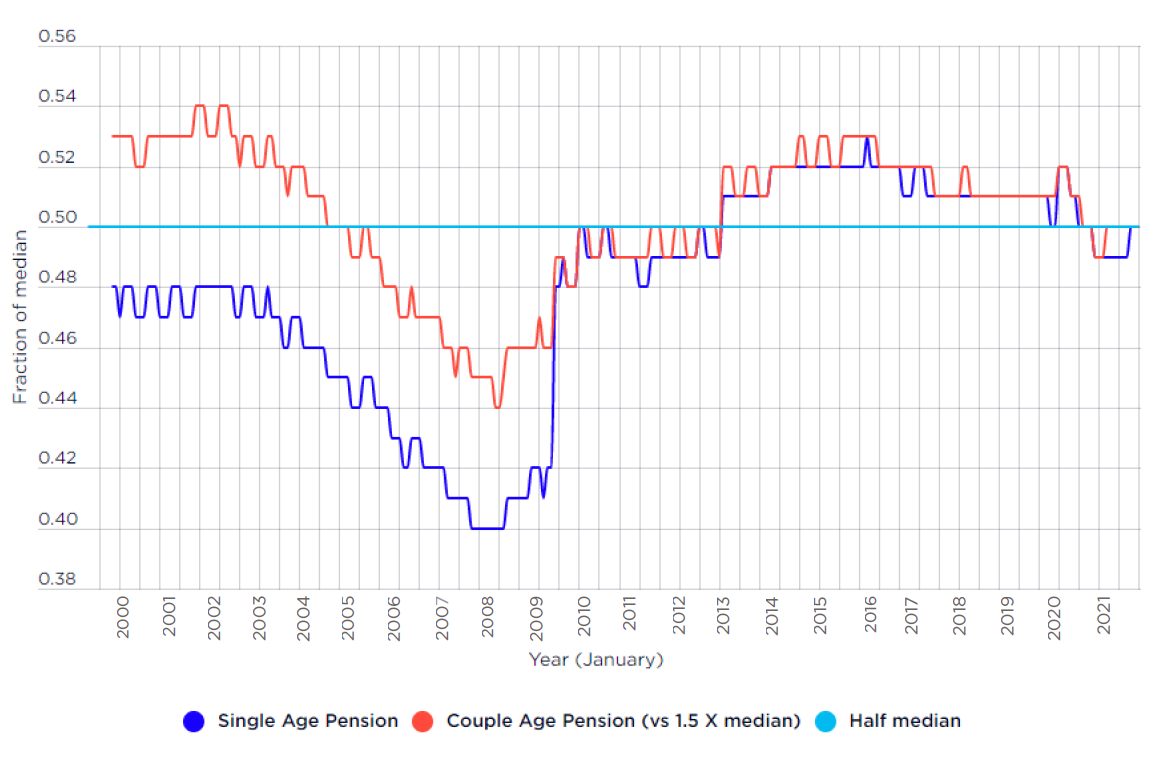

The pension payment rate[1] in Australia has long been linked to average weekly earnings and, more recently, a combination of earnings and price indices. Consequently, the pension grew steadily in real terms over the first two decades of the century (Figure 2).

However, this increase was not sufficient to keep up with the growth in median income in the first years of the 21st Century (Figure 3). Partly as a result of this divergence, but also because of a growing understanding of the relative disadvantage faced by single pensioners, the Australian government introduced a major increase in the single rate of pension in 2009 (and a small increase for partnered pensioners). This increase meant that the relative values of the single and agepension are now the same as the equivalence scale that we have used for the measurement of equivalent household income (the couple combined payment is now close to 1.5 times the single rate).

The net impact of all these changes is that partnered pensioners have almost kept up with the growth in community income over the period since 2000 (real growth of 38% vs median growth of 45%), while single pensioners have experienced a larger increase of 52 per cent in real terms. Both these payments are now very close to the ‘before-housing’ poverty line of half median income.

Figure 2: Age Pension payment rate

Figure 3: Age Pensions relative to median income

Note: The couple Age Pension is compared with 1.5 times the median equivalised household income, since the latter is in per-equivalent adult terms.

[1] Refers to the Age Pension, Disability Support Pension and Carer Payment. Parenting Payment was also paid at the pension rate until 2009 when it was excluded from the base-rate increase implemented at the time. Parenting Payment continues to be benchmarked to Male Total Average Weekly Earnings like the pension payments.

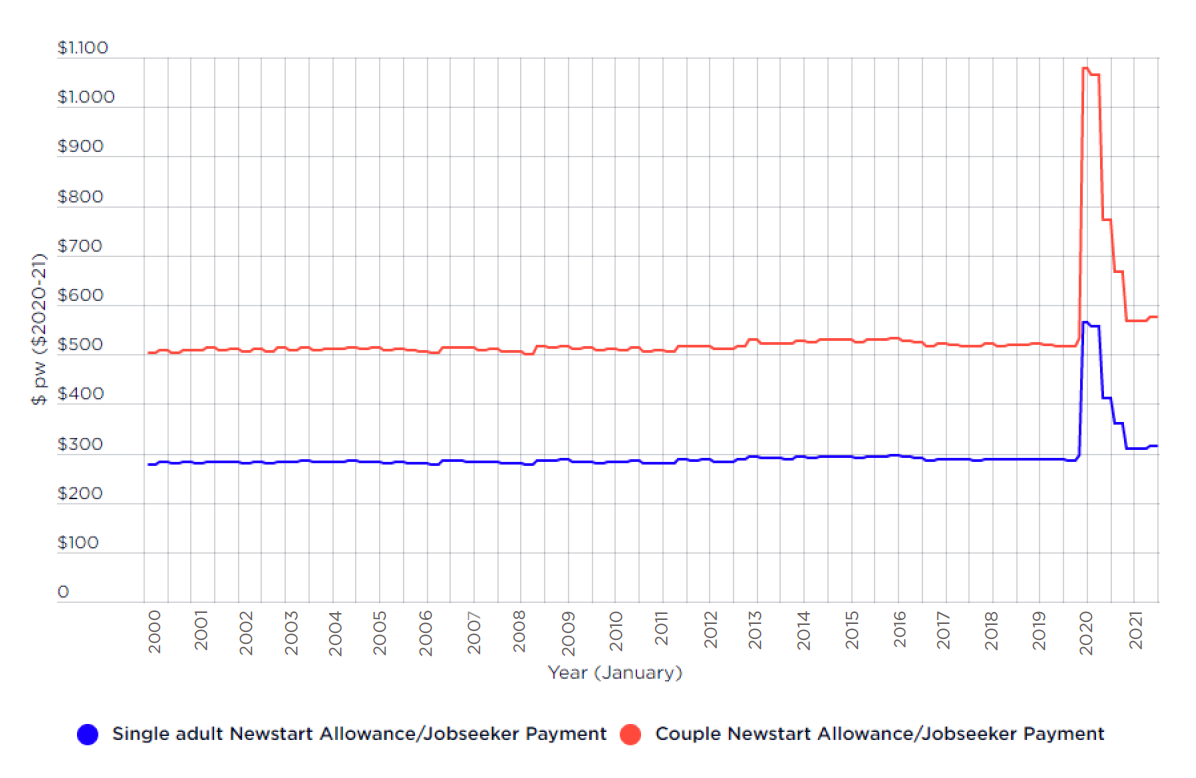

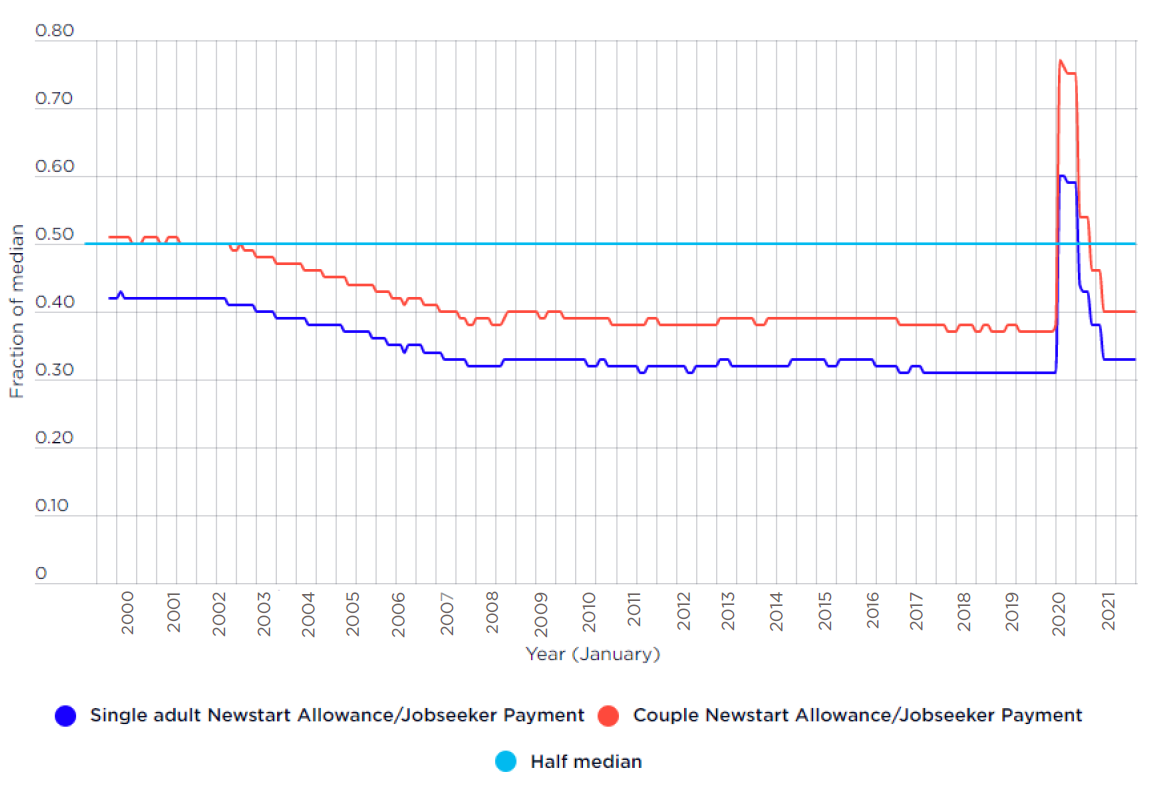

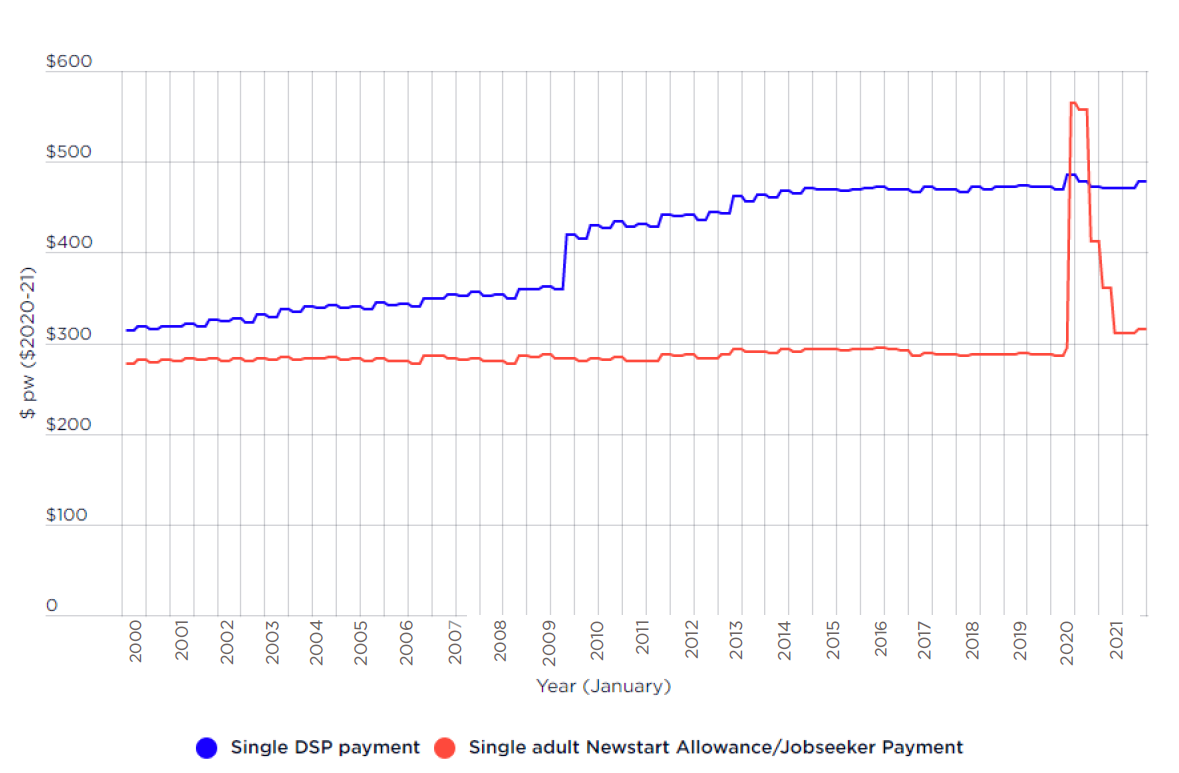

The story for people reliant upon unemployment payments (Newstart Allowance and then JobSeeker Payment) is very different. These payments had not increased in real terms since the 1990s and were far below the half median income threshold by the start of 2020 (Figure 4 and Figure 6). This was, and remains, especially the case for single unemployed people.

During the COVID-19 crisis, the numbers of recipients increased dramatically (Figure 5) as jobs were lost (and many people were ineligible for the JobKeeper payment). In addition to the increase shown in Figure 5 another 2.1 million people were receiving COVID-19 Disaster Payments in the second half of 2021 (Australian Government 2021).

During 2020 most people receiving workforce age income support payments were eligible for the Coronavirus Supplement, which effectively doubled the JobSeeker Payment rate and lifted their incomes well above the half median threshold. However, the Coronavirus Supplement was cut by more than half in September 2020, and removed by April 2021, and replaced with a small increase in the base payment rate.

The $25pw base rate increase delivered on 1 April 2021 by the Federal Government means that JobSeeker Payment has increased by 12% in real terms from July 2000 to June 2021 (which also includes the Energy Supplement introduced in 2013). Prior to this, the last time the payment was lifted above CPI was in 1994 when it rose by just $2.95pw.

Not shown in these figures are payments received by some people without paid work who were not receiving income support. This includes JobKeeper of $750 per week in 2020 (and a lower amount in early 2021), and COVID-19 Disaster Payment of up to $750 per week in the second half of 2021. Also of note is the COVID-19 Disaster Payments received by a small minority of income support recipients who had lost paid work because of lockdowns ($200 per week). The Covid Disaster Payment was only available in locations with lockdown restrictions.

As well as falling well behind the growth in median incomes, unemployment payments in Australia have also continued to fall behind minimum wages. Figure 7 shows the ratio of Newstart Allowance/JobSeeker Payment to after-tax minimum wages. This ratio is often described as a ‘replacement rate’ and is a simple indicator of the short-term financial difference for unemployed people if they can secure low-wage employment. Since 2000, this ratio has fallen from 50 to 46 per cent of the minimum wage, or down to 41 per cent if we take account of the fact that people receiving the minimum wage also receive an employer superannuation contribution. This reduction is on top of the fall in this ratio by around 4 percentage points from the mid-1990s to the turn of the century (Bradbury and Whiteford, 2020).[1]

While a need to maintain workforce incentives is often advanced as a justification to keep unemployment payments low, the rates in Australia now are both low in comparison to historical patterns and low in comparison to other countries (Bradbury and Whiteford, 2020).

Figure 4: Newstart Allowance/JobSeeker Payment rates

Note: Both payments include Coronavirus Supplement in 2020 and 2021, with an estimate of income tax deducted from it. Couples payment includes two supplements.

Figure 5: Total number of Newstart Allowance/JobSeeker Payment recipients

Note: This figure does not include the impact of the lockdowns in the second half of 2021. In addition to the JobSeeker numbers shown here, by 6 October 2021, 171,000 income support recipients were also receiving COVID-19 Disaster Payment, and 2.1 million other people were also receiving this payment (Australian Government 2021).

Figure 6: Newstart Allowance/Jobseeker Payments relative to median income

Figure 7: Newstart Allowance/Jobseeker Payments for single adult relative to the minimum wage

Note: Does not include Youth Allowance (non-student) recipients and Parenting Payment Single – activity tested recipients classed as having partial capacity to work (19,222 in June 2021).

[1] These payment rates do not include Rent Assistance. If Rent Assistance for people living in share accommodation were added, the JobSeeker payment would be 6.3 percentage points higher at the end of the period. (Including Rent Assistance would, if anything, emphasise the historical trend, as people in sharing accommodation used to receive the same maximum amount as non-sharing renters).

The Disability Support Pension (DSP) has the same base payment rate as Age Pension, and so single DSP recipients similarly benefited from the substantial increase in payments in 2009 (Figure 8). However, changing administration of the program has meant that many people who previously may have qualified for DSP are now receiving the much lower JobSeeker Payment.

These people are generally receiving JobSeeker under the ‘partial capacity to work’ criteria, which means they are on a much lower payment rate with other people who are unemployed but may qualify for reduced job search requirements. While all the people currently receiving JobSeeker under this payment criteria would not necessarily have been previously eligible for DSP, the significant growth in this cohort is a strong indicator of the extent to which people with disabilities are now receiving a lower payment rate, with its compliance requirements (Figure 9).

Considered as a fraction of the total number of people receiving DSP, Newstart Allowance/JobSeeker Payment – partial capacity to work, and the smaller Sickness Allowance, people on the lower payment rate have increased from around 5 per cent in 2007 to now 33 per cent of those with disabilities.

Figure 8: Disability payment rates

Figure 9: Disability payment numbers

Sole parents have similarly been moved onto lower payment categories over the last two decades. From mid-2006, new sole parent income support applicants whose youngest child was aged above 7 were placed onto Newstart payment rather than Parenting Payment Single (PPS).[1] This had a reduced rate of payment, a more restrictive income test, as well as additional job search requirements. Existing PPS recipients remained on the higher rate of payment until 2013 when the ‘grandfathering’ was ended.

The impact of these policy changes (on new recipients) is shown in Figure 10. The solid lines show the base rate of payment and the dotted lines the situation of a sole parent who was also earning a wage at half the full-time minimum wage rate. Sole parents with young children (7 and below) experienced a steady increase in payments over the period, while those with older children experienced a lower payment in 2006 and no subsequent real increase.

After the expiry of the Coronavirus Supplement in 2021, a sole parent whose youngest child turned 8 faced a drop in base rate of payment from $612 to $519 per week, a fall of $93.

For those with earnings, the impact of the 2006 policy change is even greater. Because Newstart Allowance/JobSeeker Payment has a harsher income test, the reduction in income is greater – in 2021 a fall of $107 when the youngest child turns 8.

The impact of the 2006 policy change, and the end of grandfathering in 2013 on the number of payment recipients is shown in Figure 11. sole parents receiving the lower rate of payment went from zero in 2006, to over 90,000 after 2013[2]. They currently comprise around 28 per cent of sole parents on these payments.[3]

Also notable in this figure is the decline in the total number of sole parents receiving income support since 2006. That is, the decline in PPS numbers has been greater than the increase in Newstart Allowance recipient sole parents. This reflects a number of factors. First, the lower payment rate and stricter income test for Newstart Allowance meant that some employed sole parents who would have been eligible for a partial payment of PPS under the old policy, were not eligible for any Newstart Allowance payments. Second, other policies were introduced after 2006 to encourage sole parent participation (or discourage them from applying for income support). Third, there has been a long-term trend of increasing employment among sole parents, pre-dating the changes to the eligibility for the PPS, both for those with young and old children.

Figure 10: After-tax income of sole parents receiving either Parenting Payment Single or Newstart Allowance/JobSeeker Payment

Note: This shows payment rates for new applicants (ie people whose payment was not ‘grandfathered’). Payments include family tax benefits and deduct income tax (for sole mother with earnings). Half minimum wage is half the value shown in Figure 1. It is assumed that employment continues in 2021 and so no Covid Disaster Payment is not included.

Figure 11: Number of Parenting Payment Single and Newstart Allowance/JobSeeker Payment sole parent recipients

[2] Around 95% of PPS recipients are women:( Department of Social Services (DSS) (2013-2021) DSS Payment Demographic Data, Department of Social Services, Canberra)

[3] Note this refers to the proportion of sole parents in receipt of PPS, JobSeeker Payment and Youth Allowance (other) only – other sole parents may receive other payments such as DSP or Carer Payment

- Australian Government (2021) COVID-19 Vaccine Roll-out, 7 October 2021, Available at: https://www.health.gov.au/sites/default/files/documents/2021/10/covid-19-vaccine-rollout-update-7-october-2021.pdf [Accessed 7 October 2021]

- Borland, Jeff and Coelli, Michael (2016), “Labour market inequality in Australia”, Economic Record, 92(299, December), 517-547.

- Bradbury, Bruce and Saunders, Peter (published online 15 September 2021), “Housing costs and poverty: Analysing recent Australian trends”, Journal of Housing and the Built Environment https://doi.org/10.1007/s10901-021-09899-w.

- Bradbury, B and Whiteford, P (2020), Submission to the Inquiry into the Social Services and Other Legislation Amendment (Extension of Coronavirus Support) Bill 2020 Community Affairs Legislation Committee (Australian Senate)

- Bray, J Rob (2013), ‘Reflections on the evolution of the minimum wage in Australia: Options for the future’ SPI Working Paper 01/2013.

All income values are expressed in 2020-21 dollars per week, deflated using the CPI (up to March quarter 2021). Values for the remainder of 2021 are fixed at March quarter price levels.

The median equivalised household disposable income is calculated from the ABS Household income surveys (generally every two years over this period). We use current household disposable (after-tax) income as recorded in the survey and adjust incomes using the modified OECD equivalence scale. We weight by persons, so that the measure is defined as the “median of the equivalised household income of people”.

To ensure consistency over the period, we use the pre-2007-08 income definition in all years, and top-code the number of children in the household to 4 when calculating equivalent income. Note that from 2007-08 onwards, the ABS also collected a wider range of income information (especially more information on fringe benefits) which, if included, would lead to a higher median income than that shown here. We exclude self-employed households and those with zero or negative income from this calculation (this has only a minor impact on median income).

The most recent ABS income survey data is for 2017-18. The ABS Distributional Accounts publication (cat 5204055011) is used to estimate the 2019-20 median. The updating from 2017-18 is based on the per-household level of Gross disposable income minus gross operating surplus of dwellings minus income tax paid. The National accounts measure of Household Disposable Income per capita is used to update from 2019-20 to 2020-21.

To estimate median incomes for specific dates, the financial year estimates from the income surveys (and updating process) are assigned to 1 January in the respective years, and intermediate dates calculated by linear interpolation of the CPI-adjusted values.

Minimum wage rate data is from the Fair Work Commission (fwc.gov.au) and Bray, J Rob (2013), ‘Reflections on the evolution of the minimum wage in Australia: Options for the future’ SPI Working Paper 01/2013.

Payment and after-tax wage rates are derived from a modified version of the Treasury CAPITA model of income policies. Wage rates and benefit incomes deduct taxes assuming constant income over the year. This is particularly relevant for the limited period when the Coronavirus Supplement was in operation (2020 and early 2021). Actual taxation would depend on income during the remainder of the financial year.

Estimates of payment rates relative to median incomes adjust for family size using the modified OECD equivalence scale on both sides of the comparison. For single person payments, this means a direct comparison of the payment rate with median equivalised income. For couple rate payments, the comparison is with the payment divided by 1.5 and the median equivalised income (which is equal to the ratio between the payment rate and 1.5 times the median equivalised income). Similarly, for sole parents with one child the payment is divided by 1.3, and a couple with one child 1.8 etc.

Sources for number of payment recipients

Figures 5, 9, and 11, Newstart Allowance, JobSeeker Payment, DSP, Sickness Allowance and PPS:

- 2000-2002: Department of Families, Housing, Community Services and Indigenous Affairs (FaHCSIA) (2011) Statistical Paper No. 9, Income support customers: a statistical overview 2010, Table 1, p.2. Available at: https://www.dss.gov.au/about-the-department/publications-articles/research-publications/statistical-paper-series

- 2003-2013: Department of Social Services DSS (2014) Statistical Paper No. 12, Income support customers: a statistical overview 2013, Table 1, p.2. Available at: https://www.dss.gov.au/about-the-department/publications-articles/research-publications/statistical-paper-series

- 2013-2021 Department of Social Services (DSS) (2013-2021) DSS Payment Demographic Data, Department of Social Services, Canberra. Available at: https://data.gov.au/data/dataset/dss-payment-demographic-data

Figure 9 Partial Capacity to Work data:

- 2007-2012 Australian Government (2012) Submission to the Senate Inquiry on the adequacy of the allowance payment system for job seekers and others. A joint interagency submission from the Department of Education, Employment and Workplace Relations, the Department of Families, Housing, Community Services and Indigenous Affairs, the Department of Human Services and the Department of Industry, Innovation, Science, Research and Tertiary Education, pp 79-80. Available at: https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Education_Employment_and_Workplace_Relations/Completed_inquiries/2010-13/newstartallowance/submissions (Submission 38)

- June 2014-2019: Department of Social Services (DSS) (June 2019) DSS Payment Demographic Data, Revised time series for Activity tested payment by work capacity Department of Social Services, Canberra. Available at: https://data.gov.au/data/dataset/dss-payment-demographic-data

- September 2019 – 2021 Department of Social Services (DSS) (2019-2021) DSS Payment Demographic Data, Activity tested payment by work capacity Department of Social Services, Canberra. Available at: https://data.gov.au/data/dataset/dss-payment-demographic-data

Figure 11 sole parents in receipt of Newstart, JobSeeker and Youth Allowance (other):

- 2006-2012 ACOSS and Jobs Australia (2020) Faces of Unemployment, p.17, Available at: https://www.acoss.org.au/wp-content/uploads/2020/04/Faces-of-Unemployment-2020-v4-1.pdf

- 2015- 2021 Department of Social Services (DSS) (2013-2021) DSS Payment Demographic Data, Principal Carers, Department of Social Services, Canberra. Available at: https://data.gov.au/data/dataset/dss-payment-demographic-data

ISSN: 1326 7124

ISBN: 978 0 85871 066 5

Australian income support since 2000: Those left behind is published by the Australian Council of Social Service (ACOSS) in partnership with UNSW Sydney. The views expressed in this report are those of the authors.

Locked Bag 4777

Strawberry Hills NSW 2012

Australia

Email: [email protected]

Website: povertyandinequality.acoss.org.au

© ACOSS and UNSW Sydney, 2021

This report is copyright. Apart from fair dealing for the purpose of private study, research, criticism or review, as permitted under the Copyright Act, no part may be reproduced by any process without written permission. Enquiries should be directed to the Publications Officer, Australian Council of Social Service. Copies are available from the address above.

Suggested citation: Bradbury, B and Hill, T (2021) Australian income support since 2000: Those left behind ACOSS/UNSW Sydney Poverty and Inequality Partnership, Build Back Fairer Series, Report No. 2, Sydney

Cover photo © by Sergio Valena on Unsplash